Despite a focus on “fairer distribution” of newly issued tokens, so-called Initial DEX Offerings (IDOs) tend to benefit only the most advanced traders, much in the same way as the now-infamous Initial Coin Offerings (ICOs) of 2017, a crypto research firm Messari warned.

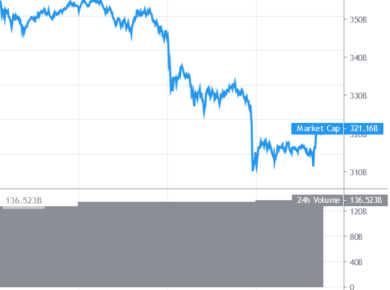

The warning comes on the heels of a summer that has yielded huge returns for many DeFi-related cryptoassets, most of which were launched on decentralized exchanges (DEXs) like Uniswap in recent months. But with the DeFi market having just gone through its largest drawdown so far, Messari now said that the boom bears similarities with the ICO craze from 2017.

“Looking at five of the most recent token offerings, however, it’s apparent not much has changed. In the latest incarnations of the ICO, several early participants have been able to make off with outsized returns while others have been left deeply in the red,” the researchers said.

The firm went on to explain that although the IDO model for token distributions should “in theory” even out the playing field, traders with the most advanced bots have still been able to benefit at the expense of others by taking on nearly risk-free trades.

“In practice, it turns into a competitive game amongst the most advanced bots to front-run the retail market,” Messari’s researchers wrote, adding that “the only tokens sit in the AMM [automatic market maker] pool, which by default, can only be bought. This means that the fastest bots are competing over a risk-free trade because initially, the price cannot possibly go down.”

Knowing this, Messari went on to warn retail traders against the risks of participating in IDOs, saying that unless a trader can “submit orders within seconds of the offering going live,” it’s best to stay away and “wait for the market to settle on a price before buying.”

The firm’s findings were also summarized on Twitter by Messari researcher Jack Purdy, who advised new investors to steer clear of “plain vanilla” IDOs, saying “you’re better off waiting for the market to settle rather than trying to beat out the bots.”

____

Learn more:

‘If DeFi Collapsed, Bitcoin Would Still Be Bitcoin’

DeFi Sell-Off Just ‘a Pullback,’ Boom Not Over Yet – Analysts