French businessman Alexandre Raffin, who runs the Paris-based Gains Associates, a company that allows investors to pool their money and buy crypto, has filed a lawsuit in an Australian court against crypto advisory and research company Modern Assets Australia. Raffin accused the Australian firm of an alleged scam related to a failed deal to buy tokens built on the Klaytn platform, a blockchain project backed by South Korea’s Internet giant Kakao – claiming he lost more than USD 600,000 after the market skyrocketed.

Raffin is accusing the firm and its directors, Jonathan Allison and Carlo Sciubba, of breaching their duty of care to him and failing to perform due diligence on the tokens’ supplier, as reported by the Australian Broadcasting Corporation.

Modern Assets Australia was allegedly supposed to provide 937,500 tokens to him in exchange for about AUD 93,000 (USD 71,000) in cash. After the initial deal foiled, the firm connected Raffin directly with the seller. However, about one month later, the seller disappeared with the cash and deleted their encrypted account.

Given the token’s subsequent price spike, Raffin and his investors claim they could have multiplied their initial investment to close to AUD 3.7m (USD 2.8m). The French investor is now seeking damages and close to AUD 800,000 (USD 609,000) which he says is what the cryptocurrency would have been worth last August.

Raffin decided to pay back his investors mostly out of his own pocket, a process he describes as “very, very painful financially” as, at that time, the money represented some 80% of his assets.

The businessman has also hired a cyber investigation company to trace back the funds, but eventually resorted to filing a lawsuit in the Federal Court of Australia.

“I’m a pretty tough guy. I’ve become quite desensitized to money through these years in crypto,” Raffin said. “You lose some, you win some. But this was hard, even for me.”

Commenting on what is believed to be the first cryptocurrency fraud case of this kind in Australia, a spokesperson for Modern Assets Australia said the company denies the allegations and would be “vigorously defending the allegations.”

Our has reached out with requests for comment to both Gains Associates and Modern Assets Australia.

Meanwhile, Klaytn came out with several news recently: it was announced that Klaytn will be supported by non-fungible tokens (NFTs) marketplace OpenSea, while the major business newspapers, The Korea Economic Daily, started using the blockchain.

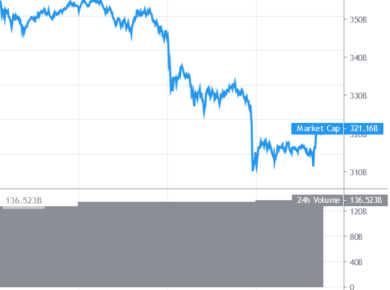

KLAY, Klaytn’s native digital asset, is up 36.5% in a week and nearly 200% in a month (at 9:35 UTC), trading at USD 4.07. It’s market capitalization is currently sitting at USD 9.98bn, after it hit USD 10m on two consecutive days prior.

____

Learn more:

Kakao’s Klaytn Sacrifices Decentralization to Beat Ethereum on Speed

Kakao Welcomes Binance to Klaytn Council in ‘Scene-shaking’ Move

South Korean Tech Giants May Capitalize on ‘Rising Crypto Pay Demand’