US-based major cryptoasset investment firm Grayscale launched five new trusts, while its biggest, bitcoin (BTC) trust is unavailable for investing again.

The Grayscale family has been joined by chainlink (LINK), basic attention token (BAT), decentraland (MANA), filecoin (FIL), livepeer (LPT) trusts.

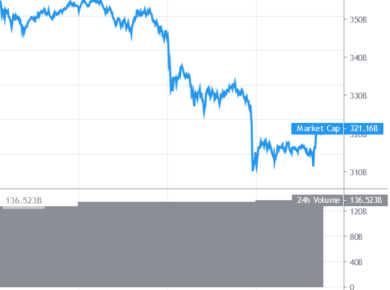

Following the news, LINK jumped by 8% in the past hour, BAT rallied 12%, MANA – 21%, FIL – 6.5%, and LPT, ranked 170th by market capitalization, skyrocketed by 106%.

The minimum investment in these trusts is USD 25,000 and there’s a 2.5% annual fee. In comparison, it’s USD 50,000 in the case of Grayscale Bitcoin Trust (GBTC), which is currently unavailable. “All of Grayscale’s funds periodically close for administrative purposes,” a Grayscale spokesperson previously told Our. GBTC, which now holds BTC 655,140 (USD 36bn), was reopened in January.

As reported, in February, the company confirmed that it’s looking into at least 23 different digital assets “for potential new product offerings” as Bitcoin exchange-traded funds (ETFs) are gaining traction in Canada and new competitors for Grayscale emerge.

“At any one time, we’re probably maintaining a list of what could be 30 products, could be 40 products that we’re interested in bringing to market,” Grayscale CEO Michael Sonnenshein told Bloomberg. “We’re trying to always reconcile where we may find compelling opportunities in the digital assets ecosystem and trying to reconcile where investors are interested in deploying capital.”

According to him, “there are many Grayscale products that have historically been a little bit before their time, before they began to resonate with investors sufficiently.”

For example, the least known among the five new cryptoassets is livepeer.

“LPT serves as the native digital currency for the Livepeer Network, a subnetwork on the Ethereum Network. Livepeer aims to build a platform for decentralized video broadcasting and streaming. By incenting a network of participants, Livepeer hopes to provide a cheaper, more scalable, and censorship-resistant solution to video infrastructure,” Grayscale explained.

Meanwhile, Digital Currency Group, the parent company of Grayscale, said in March that it plans to purchase up to USD 250m worth of shares of GBTC.

While other trusts, such as Bitwise, BlockFi, Osprey Bitcoin Trust, and Canadian Bitcoin ETFs are emerging, the Grayscale trusts have so far been a dominant way for institutional investors to enter the cryptoverse.

The trusts are structured to hold the underlying crypto, while the value of each share is dependent on the amount of crypto under management. They also provide a familiar structure for accounting and taxation. However, there is no way to redeem the underlying crypto.

___

Learn more:

– Bitcoin, Ethereum Rally Despite Inflows To Grayscale’s Trusts Slow Down

– Ark’s Cathie Wood & Grayscale’s Michael Sonnenshein Talk Bitcoin

– Grayscale Ethereum Inflows Up Again, Firm Calls ETH Valuation Methods ‘Opaque’

___

(Updated 13:37 UTC with the market reaction. Updated at 13:45 UTC with the data about Grayscale’s trusts. Updated at 13:48 UTC with information about an annual fee. Updated at 14:33 UTC with comments from Grayscale CEO and description of Livepeer.)