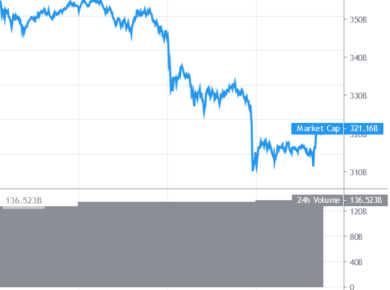

After a short-lived, but significant premium was seen on ethereum classic (ETC) on Coinbase Pro early Wednesday morning UTC time, traders wonder whether the exchange was subject to an organized pump-and-dump, or if there are other factors that makes ETC markets more prone to premiums developing than those of other major cryptoassets.

Although ETC has traded with a slight premium on Coinbase Pro versus exchanges like Binance and Bitfinex since at least 11:30 PM UTC time on Tuesday, the price started to spike significantly higher on the popular exchange at around 3 AM (UTC time) Wednesday morning. The premium then continued to increase over the next two hours, until just after 5 AM, when the spread between Coinbase Pro and other exchanges quickly collapsed to about the same level as it was earlier on Tuesday night.

As of press time Wednesday morning (08:30 UTC), a premium is still present on Coinbase Pro, with ETC trading at USD 6.41 on Coinbase Pro versus USD 6.37 on both Binance and Bitfinex, although the price gap from other exchanges has significantly narrowed.

At its widest, the premium on Coinbase made the asset as much as 10% more expensive in US dollar terms on the exchange, theoretically representing a significant arbitrage opportunity for traders to buy ETC on another exchange and sell it on Coinbase Pro.

$ETC mooning on @CoinbasePro https://t.co/7iuuJyS08t

— Su Zhu (@zhusu)

Given the large amount of arbitrage trading that we know takes place every day in the crypto market, the obvious question then becomes why and how the large premium developed on Coinbase.

As pointed out by several community members of Twitter, however, Coinbase and other exchanges like Kraken have implemented strict confirmation time requirements for ETC deposits due to the danger of 51% attacks on the ETC network. For instance, Kraken’s website states ETC deposits require 43,200 confirmations – estimated to take a whole week – before it will be credited to an account. Coinbase, on the other hand, should, in theory, be more efficient, with 3,527 confirmations required for ETC transactions, according to a blog post from the company.

By comparison, Binance requires 100 confirmations for ETC to be deposited to a user account, making it more efficient for traders to take advantage of arbitrage opportunities that arises.

@SBF_Alameda @lawmaster @zhusu This. sending it in and out of cb has risks.

— I am Nomad (@IamNomad)

Our has reached out to Coinbase for a comment and will update this article as soon as we receive a reply.